Estate planning is the preparation of tasks that serve to manage an individual's asset base in the event of their incapacitation or death. The planning includes the bequest of assets to heirs and the settlement of estate taxes. Most estate plans are set up with the help of an attorney experienced in estate law.

Estate planning involves planning for how an individual’s assets will be preserved, managed, and distributed after death. It also takes into account the management of an individual’s properties and financial obligations in the event that they become incapacitated. Assets that could make up an individual’s estate include houses, cars, stocks, paintings, life insurance, pensions, and debt. Individuals have various reasons for planning an estate, such as preserving family wealth, providing for surviving spouse and children, funding children and/or grandchildren’s education, or leaving their legacy behind to a charitable cause.

The most basic step in estate planning involves writing a will.

Writing a Will: A will is a legal document created to provide instructions on how an individual’s property and custody of minor children, if any, should be handled after death. The individual expresses their wishes through the document and names a trustee or executor that they trust to fulfill the stated intentions. The will also indicates whether a trust should be created after death. Depending on the estate owner’s intentions, a trust can go into effect during their lifetime or after the death of the individual.

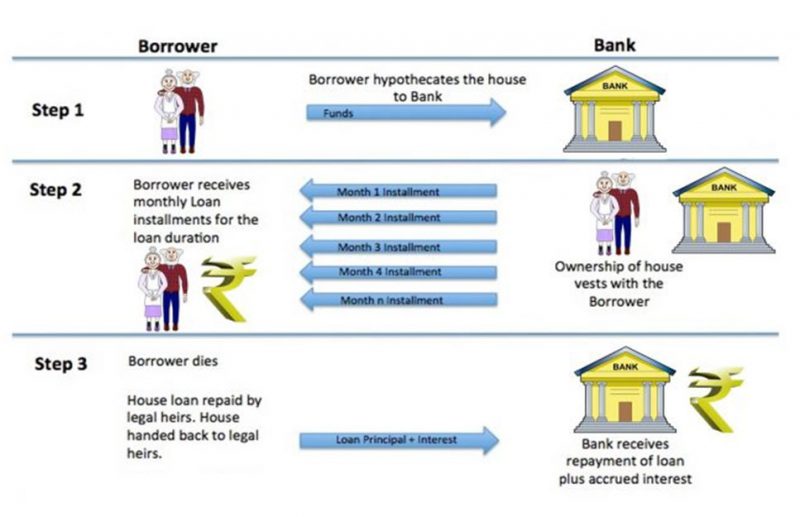

REVERSE MORTGAGE: An alternative source of retirement cashflow

Reverse Mortgage is the opposite of a regular home loan. In a Reverse Mortgage, a senior citizen mortgages his property to a lender (bank), which then makes periodic payments to the borrower so that borrower can meet his monthly expenses. During the loan tenure if one of the spouses dies, the other can continue to live in the house until the loan period is over. If however, the borrowers continue to live beyond loan period, they can stay in the house but will not receive monthly payments. Upon the death of both husband and wife, the Bank gives two options to their legal heirs –

(1) to settle the outstanding loan and retain the house, or

(2) the Bank will sell the house, use the proceeds to settle the outstanding loan amount and handover the balance amount to legal heirs.

Open your Life Time FREE Accont Now

Get in Touch: +91 - 9775561666 connect@mysipindi.com